Mayfair of McLean Association

Reserve Funding Analysis Due Diligence Meeting

September 22, 2021

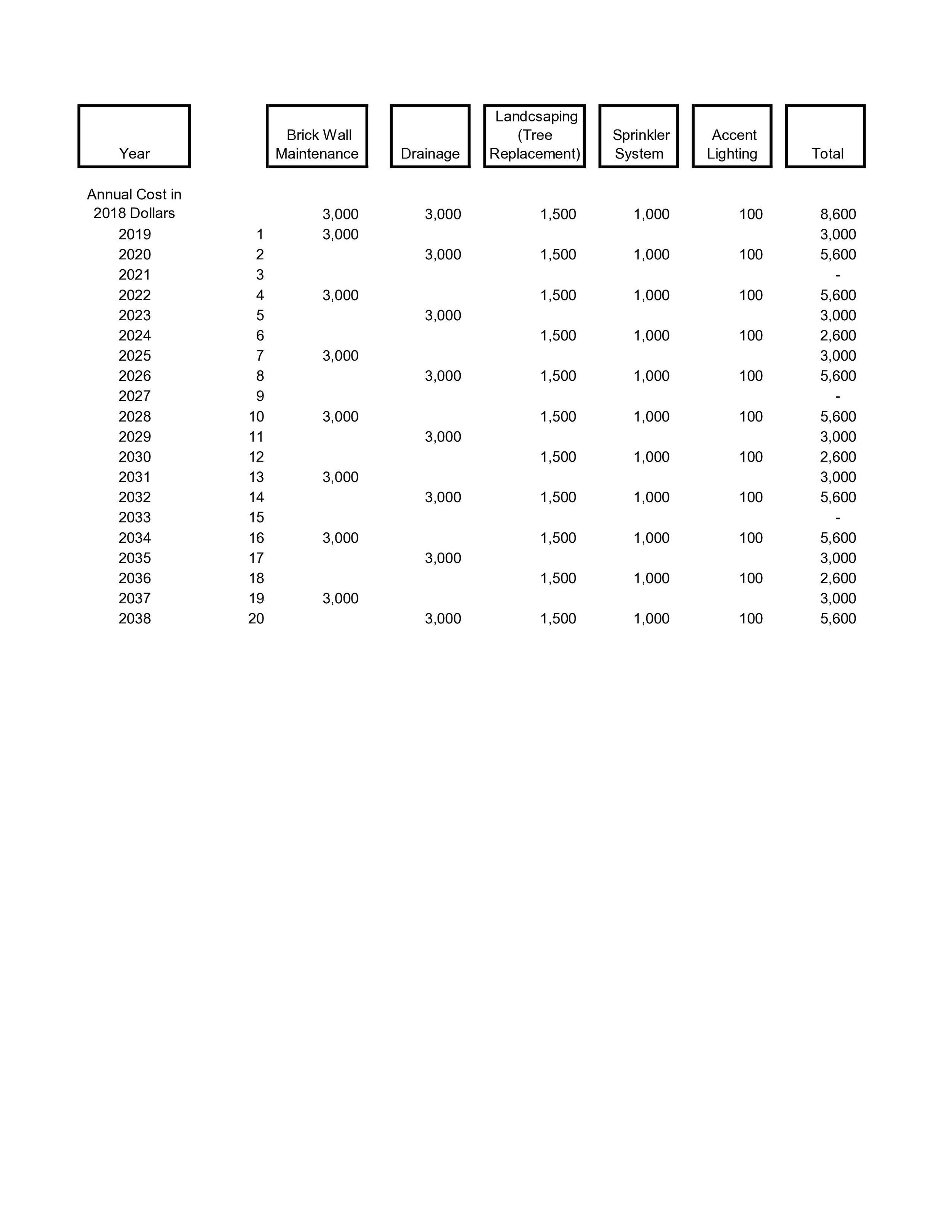

Attendees of the Reserve Funding Committee meeting included Pres. John Mockoviak, Vice President Bill Wilhoyte, Treasurer Larry Warren, Assistant Treasurer Paul Malarkey, Secretary Julie Warren, and pro bono reserve analyst Bruce Louiselle. The group met on Sept. 22 to discuss Mayfair of McLean’s reserve analysis and review what components are covered by reserves—including the new components that were added in 2018—and the forecast funding for each. Mayfair of McLean’s reserves are funded with $2,500 quarterly from the operating budget as well as with any unspent operating funds after all invoices and financial commitments are paid at the end of the calendar year. Per the reserve analysis, the Association forecasts $257,000 in future expenditures over the next 20 years.

The Virginia Property Owners Association Act requires that common-interest communities conduct a reserve study of material components every five years. Virginia statute also requires that any resale disclosure packet for a property in a common-interest community include a statement of that community’s current reserve analysis, which anticipates maintenance and replacement expenditures for common property and infrastructure, and a statement of the status and amount of reserve funds to cover those expenses.

This meeting was called to review and update Mayfair of McLean Association’s list of reserve components and conduct due diligence to ensure that the scheduled reserves are appropriate and the reserve analysis is current. Mayfair of McLean Association’s reserve study, which projects needed expenditures through 2039, is based partially on material available through Community Associations Institute and largely on the community’s history.

Call to Order and Attendance

Board President John Mockoviak called the meeting to order at 2 pm EDT and thanked everyone for coming. In addition to Mockoviak, attendees included all Mayfair of McLean officers—Vice President Bill Wilhoyte, Board Secretary Julie Warren, Treasurer Larry Warren, and Assistant Treasurer Paul Malarkey—and Bruce Louiselle, Mayfair of McLean’s pro bono reserve analysis consultant.

A retired McLean attorney, Louiselle also was a consultant for more than four decades specializing in economic, financial, and policy issues concerning integrated electric utilities. He is a former Mayfair of McLean resident and was the community’s Board president for several years. During his 20 years as a Mayfair homeowner, Louiselle played a major role in reviewing, monitoring, revising, and making recommendations concerning Mayfair of McLean’s reserve study and its funding. At one time, Louiselle also was an instructor specializing in public utility economics at George Washington University, where he earned both a bachelors and a JD degree.

Reserve Analysis Review and Discussion

Prior to 2018, the Mayfair of McLean Board’s practice was to hire an independent engineering company to conduct the association’s required reserve study. The cost for a reserve analysis was about $5,000 per study.

Louiselle reminded the committee that since that time, the Association has conducted the required reserve study internally and more frequently than required by law, saving the association several thousand dollars per study. He also reminded the committee that, per the Association’s experience, while reserve studies conducted by outside consultants determined ultimate replacement costs for each component, these studies haven’t always provided costs or schedules for periodic repairs or maintenance. In allowing for periodic repairs and maintenance in the reserve study, the Association is able to extend the useful life of each component and delay somewhat its inevitable replacement.

President Mockoviak pointed out that a Mayfair of McLean Task Force convened a few years ago to review the frequency of special assessments in Mayfair of McLean recommended property insurance 2 on several components, including the exterior brick wall and the monument entrance. The Association now has $240,000 policy on these components.

Committee members reviewed the individual components covered by reserves—including several items that were added in 2018—and the forecast funding and schedule for each. The time range on a number of components was adjusted to be in line with industry standards as recommended in Reserve Funds: How and Why Community Associations Invest Assets, a guidebook available through Community Association Institute, Mockoviak says. Larry Warren cautioned that with the rising cost of building materials, the Board also should be aware that the 2.5% escalation rate incorporated in the reserve analysis could increase quickly.

Action items from the meeting include:

Verify the 2018 cost for road milling and resurfacing and adjust as necessary. At that time, the road was paved in conjunction with an unavoidable Fairfax Water Authority project, so the community was only required to pay a portion of the repaving project.

The Board will review and approve the revised funding analysis at its next meeting on October 13, 2021.

Homeowners are encouraged to review the most recent reserve analysis, available on the association’s website with the Aug. 23rd Board meeting minutes, which includes long-term maintenance and replacement cost projections for common-area components such as the brick wall and monument entrance, the wooden perimeter fence, street and accent lighting, sprinkler system, mailboxes, and the road, curbs, and sidewalks.

Mayfair of McLean’s Reserve Fund is funded each quarter with $2,500 from the operating budget and any amount left over in the operating budget at the end of each year after all invoices and contracts are paid in full. The 2021 year-end reserve balance is expected to be $83,400 with the fourth quarter $2,500 contribution and assuming there are no expenditures through the end of this calendar year.

Meeting Adjourned

After a motion, a second, and unanimous voice vote to do so, Pres. Mockoviak adjourned the meeting at 3 p.m.

This Reserve Funding Analysis, performed in October 2021, was for the Five Year Period of 2022 - 2026. The next meeting of the Officers will be October 2026. The board reviews the Reserve Funding Analysis annually.